when are property taxes due in madison county illinois

For comparison the median home value in Madison County is. The average homeowner in Illinois paid 4737 in property taxes the second highest amount in the nation.

Madison County Kentucky Genealogy Familysearch

Madison County Treasurer IL 157 North Main Street Ste.

. Payment of the installment due on June 1 2022 with interest beginning on June 2 2022 at 55 per month post-mark accepted. Illinois was home to the nations second-highest property taxes in 2021. 125 Edwardsville IL 62025 618-692-6260.

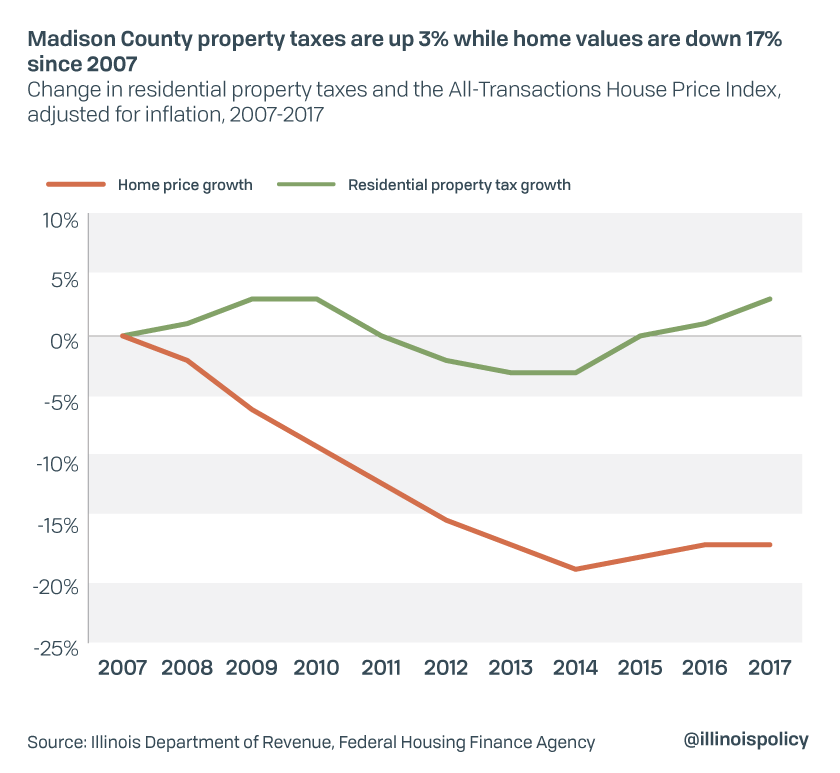

Madison County Clerk PO. Statement of Economic Interest. Property taxes in Illinois have been on the rise in recent years.

CHRIS SLUSSER Madison County Treasurer IL 157 North Main Street Ste. Current Tax Year-Taxing District Levy. 2019 payable 2020 tax bills are being mailed May 1.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. Illinois gives real estate taxation power to thousands of community-based public entities. Payment of property taxes may be made in person from 8 am.

Monday - Friday E-mail. Box 218 Edwardsville IL 62025. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600.

Still property owners generally pay a single consolidated tax levy from the county. Pay your Madison County Illinois property tax bills online using this service. 1 day agoANDERSON The fall installment of Madison County property tax payments will be due Nov.

Click here Pay your Madison County property. LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at. Madison County Auditor Check Register.

Welcome to Madison County Illinois. EDWARDSVILLE Madison County Treasurer Chris Slusser is reminding taxpayers that the third installment of their tax bill is coming due on Friday Oct. Will County Il Property Tax Due Dates 2022.

Now rampant inflation is giving local taxing bodies the power to raise rates by 5. If you are making payments after January 3rd due to interest and late fees please call our office at 256 532-3370 for an exact tax amount due. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Property tax due dates for 2019 taxes payable in 2020. 125 Edwardsville IL 62025. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on.

Madison County collects on average 175 of a propertys. When are taxes due in Madison County. In most counties property taxes are paid in two installments usually June 1 and September 1.

Madison County Property taxes are paid in four installments. Madison County Auditor Financial Reports.

Madison County Home Values Down 17 Property Taxes Up 3 Since Recession

Illinois Disabled Veteran Exemption Costs Taxpayers Schools Belleville News Democrat

Madison County Il Board Votes To Strip Prenzler Of Powers Belleville News Democrat

Illinois Property Tax Calculator Smartasset

Madison County Il For Sale By Owner Fsbo 53 Homes Zillow

Local Taxes Edwardsville Illinois

Terms Madison County Treasurer Il Online Payments

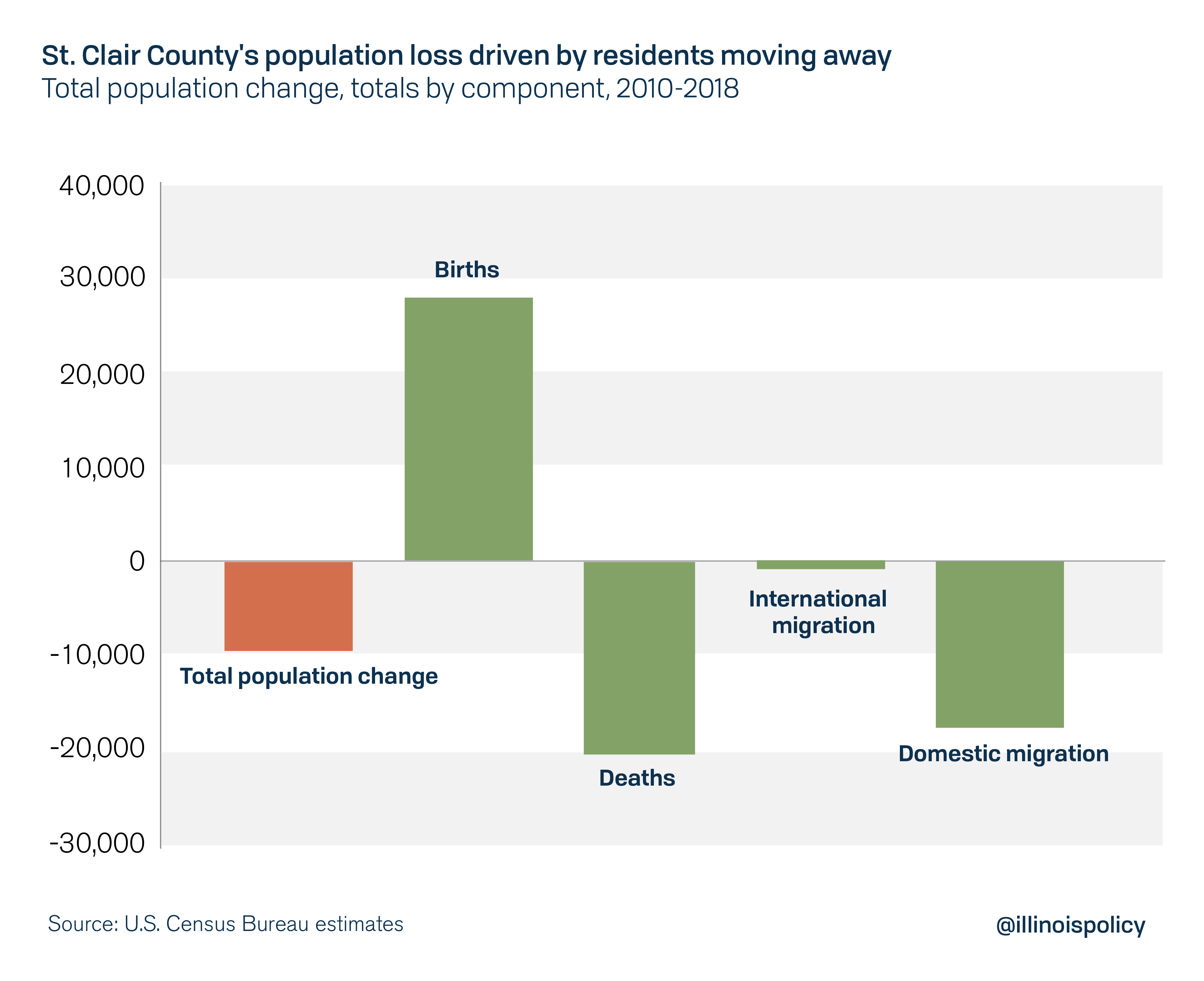

Pension Costs Push Metro East Property Taxes Up As Population Shrinks Madison St Clair Record

Property Taxes By County Interactive Map Tax Foundation

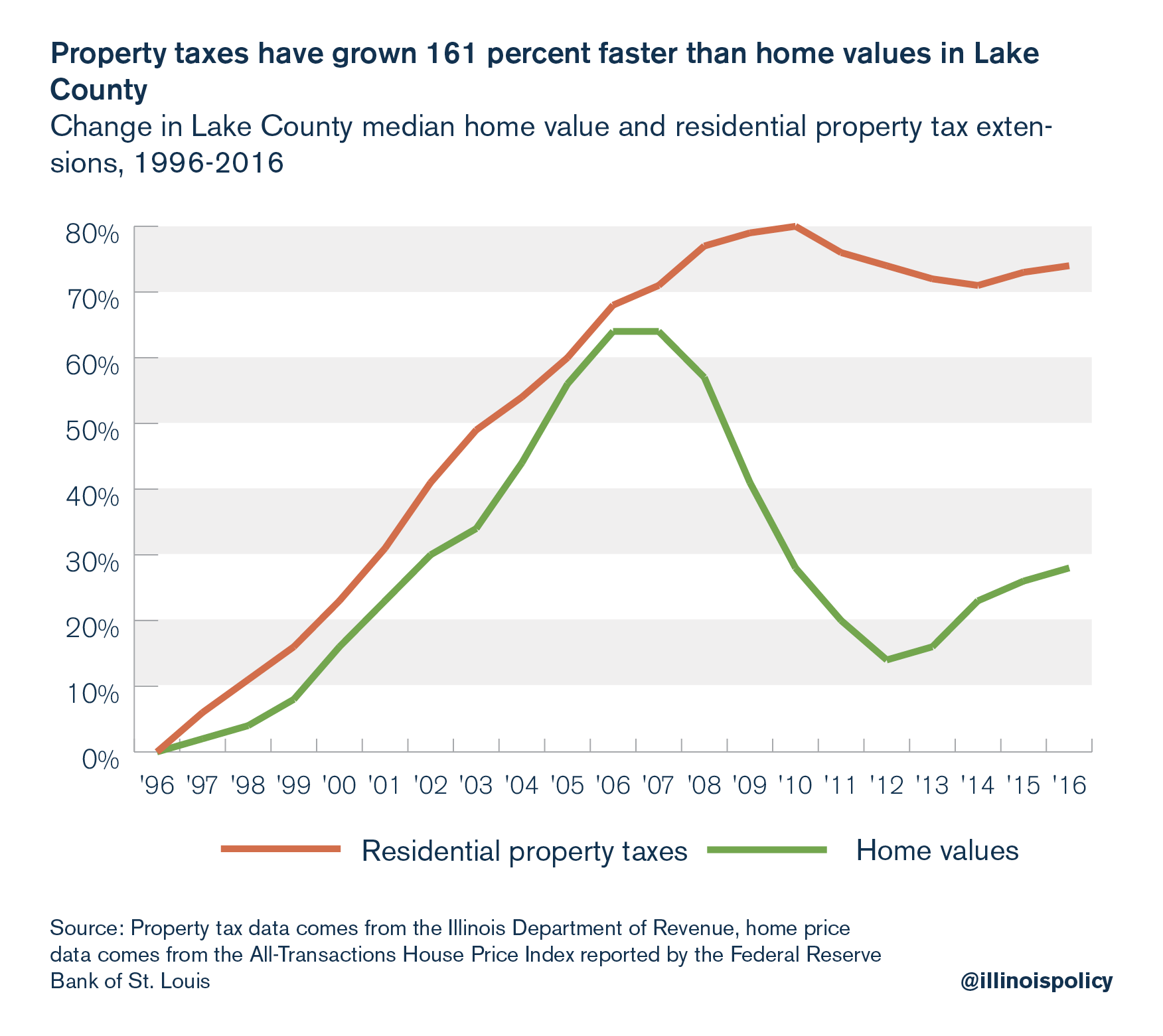

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

Kurt Prenzler Cpa Madison County Chairman

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Illinois Rising Property Taxes Driven By 75 Billion Local Pension Debt Madison St Clair Record